The term “stock market,” “equity market,” or “share market” refers to the gathering of buyers and sellers of stocks, also known as “shares,” which are ownership claims on businesses. Securities listed on a public stock exchange and privately traded stock, such as shares of private companies offered to investors through equity crowdfunding platforms, can both be considered stocks. Typically, while making an investment, one has an investment strategy in mind.

There are sixty stock exchanges worldwide as of 2016. Of these, 16 exchanges represent 87% of the worldwide market capitalization and have a market capitalization of $1 trillion or more. These sixteen exchanges are located in North America, Europe, or Asia, with the exception of the Australian Securities Exchange.

According to country, as of January 2022, the United States of America (approximately 59.9%) had the largest stock markets, followed by Japan (about 6.2%) and the United Kingdom (about 3.9%).

Stock Market Functions

Along with the debt markets, which are typically more demanding but do not trade publicly, the stock market is one of the most significant avenues for firms to raise money. This enables companies to be listed on public markets, where they can sell shares of their ownership to raise further funding for growth.

Investors’ assets can be sold swiftly and easily because to the liquidity that an exchange provides. When compared to less liquid investments like real estate and other immovable assets, this is a compelling aspect of stock investing.

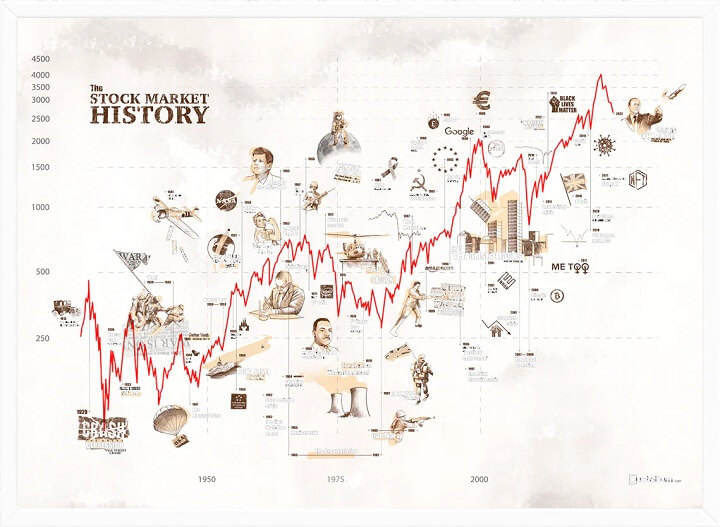

History has shown that the price of stocks and other assets is an important part of the dynamics of economic activity, and can influence or be an indicator of social mood. An economy where the stock market is on the rise is considered to be an up-and-coming economy.

Rising share prices, for instance, tend to be associated with increased business investment and vice versa. Share prices also affect the wealth of households and their consumption. Therefore, central banks tend to keep an eye on the control and behavior of the stock market and, in general, on the smooth operation of financial system functions. Financial stability is the raison d’être of central banks.

The smooth functioning of all these activities facilitates economic growth in that lower costs and enterprise risks promote the production of goods and services as well as possibly employment. In this way the financial system is assumed to contribute to increased prosperity, although some controversy exists as to whether the optimal financial system is bank-based or market-based.

Stock Exchange | Stocks Marketing

An exchange, often known as a bourse, is a place where traders and stockbrokers can purchase and sell bonds, shares, and other assets. Stocks of numerous big businesses are traded on stock exchanges. Because of this, the stock is more liquid and therefore more appealing to investors.

Other securities, including bonds with set interest rates or (less frequently) derivatives, which are more likely to be sold over-the-counter, may also be listed on stock exchanges.

Additionally, the exchange might serve as a settlement guarantee. It is also possible to trade these and other stocks “over the counter” (OTC), that is, through a dealer. To draw in foreign investors, several big businesses list their stock on multiple exchanges across many nations.

Open outcry trading occurs on a trading floor in certain exchanges, which are actual physical sites. This technique, which involves dealers yelling bid and offer prices, is utilized in certain stock and commodity exchanges.

A stock exchange serves as a marketplace by facilitating the exchange of securities between buyers and sellers. Price discovery is aided by the exchanges’ provision of real-time trading data on the listed securities.